Pressure on revenue and margins – the importance of full capacity and service uptime.

Over the past decade, UK industrial, processing, and manufacturing sectors have faced significant financial challenges due to escalating operational and capital costs. Land values have surged, with industrial land and even greenbelt farmland prices rising notably, despite higher borrowing and interest costs.

Energy costs in the UK are among the highest in the world, the cost of being the Net-zero leader. According to the Office for National Statistics (ONS), UK industry pays 45 – 50% higher prices for electricity than the average European nation – and four times that of USA and Canada.

Additionally, labour costs have reached unprecedented levels, with the labour cost index climbing to 115.80 points in 2024, the highest since records began in 1997. This was before the bedrock of UK employment and GDP was hit with the Chancellor’s triple-tap hike to employment costs in April 2025. The new £5,000 threshold rule, alongside the NIC percentage increase, is expected to disproportionately impact manufacturing and primary industries’ labour costs.

Over the past 10 years, the National Living Wage and NIC increases have grown the cost of employing operational staff by around 150%, while planning permission and permitting-associated costs have continued to grow. During the same period, many factory gate prices have failed to keep pace. Take building materials for instance; even accounting for the pandemic-driven price jump, primary building materials only increased by 4 to 5% per annum as a nine-year average, leaving today’s bulk aggregates market walking a fine line between profit and loss.

Price Indices of Example Construction Products, 2015 – 2024

| Product | % Increase (2015–Dec 2024) | Compound Annual Increase (9yr avg %) |

|---|---|---|

| Gravel, sand, clays & kaolin, excluding Aggregates Levy | 54.3 | 4.9 |

| Gravel, sand, clays & kaolin including Aggregates Levy | 46.2 | 4.3 |

| Cement | 41.0 | 3.9 |

| Lime & plaster | 60.3 | 5.4 |

| Ready-mixed concrete | 54.8 | 5.0 |

| Other mining & quarrying products, including Aggregates Levy | 43.9 | 4.1 |

| Other mining & quarrying products, excluding Climate Change Levy | 51.6 | 4.8 |

| Mining support services incl CCL CPA group B09 |

33.5 | 3.3 |

| Machinery for mining, quarrying & construction | 35.1 | 3.4 |

Data sourced from the Office for National Statistics Producer Price inflation – MM22, published 15th Jan 2025.

Land is a finite resource and now faces extra competition for use, particularly in built-up countries like the UK. The growth of natural capital and credit offsetting markets, and space-hungry solar and wind farms, is likely to further increase the cost of traditionally low-cost sites, long favoured by bulk material and heavy-duty manufacturing firms. Furthermore, planning applications are getting more complex with the increased requirement for surveys, consultations, and mitigations.

What does this mean for the industry?

The result of all this is that new production sites and other capital projects need to work at high capacity from Day One, if they are to meet financial targets and investor expectations.

For existing plants, quarterly – even annual results – can be skewed by a single equipment outage, or delay in dispatching goods.

“10 years ago, we could run our process wash-plant at only 30-40% utilised [capacity], and still be OK. Today our equipment has to run at over 80% uptime just to breakeven” a senior manager at a large UK heavy-side building materials manufacturer recently told Atlantic Pumps.

“With pressure on budgets and high interest rates, new capital projects can be difficult to finance. This has resulted in many older sites running at 100% capacity and companies finding that aging equipment is sapping operating margins through a lack of energy optimisations, and expensive part replacements” explains Andy Smith, of Atlantic Pumps.

Ensuring full uptime, rapid and timely servicing of equipment, and energy savings are now vital necessities, rather than purely best-practice and lofty target goals.

Recognising this reality, British Steel’s Lead Engineer for Energy Operations demonstrated pro-active and decisive action to reduce the cost of pumping water from a lagoon at Scunthorpe. Assessing the savings potential of switching from diesel, dry-sited pumps to electric submersibles, he gave Atlantic Pumps the challenge of making a low-cost, effective dewatering system.

This resulted in a newly improved pontoon design with Audex submersible pumps. The new install resulted in improved reliability, energy savings and lower maintenance for British Steel.

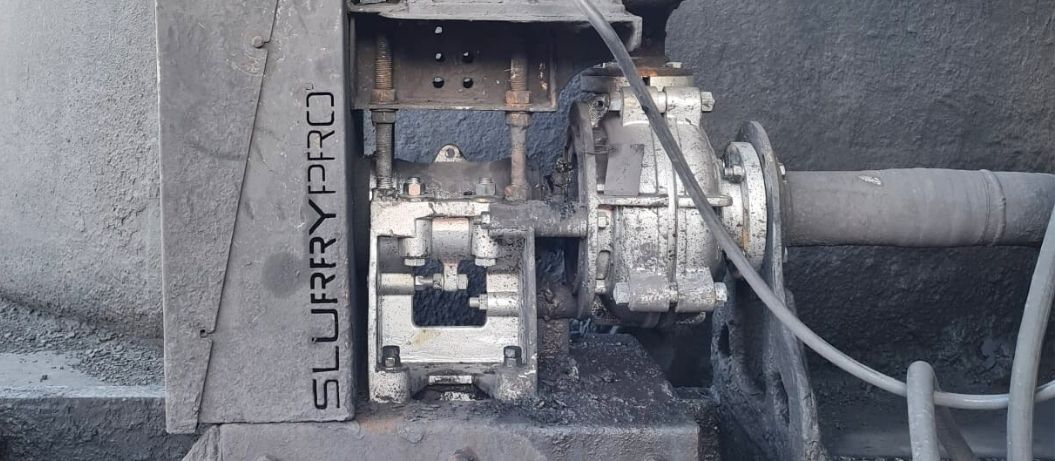

Atlantic Pumps are the chosen technology partner for wet and dry bulk material systems, with a particular focus on increasing uptime and ROI in high wear and challenging industrial applications. Talk to us about Pump audits, equipment specification and design consultancy, plus after-market optimisations of wet and dry bulk material processing, on-site and off-site pump servicing and repairs, new pump builds and system installs, reducing pump maintenance costs, remote data and control software, and pre-emptive condition-based monitoring.

Looking for more information on what you’ve read today?

Talk to one of our experts – we're here to help.

We also take a sustainable approach to our work and are committed to reducing energy waste from pumps. Our expert knowledge allows us to reduce energy usage by 20% on the average site!

Call us today on 0808 196 5108 for more information.

July 30 2025

July 30 2025 6 min read

6 min read